“He chose Dallas before the world noticed.”

The digital clock on his monitor reads 2:37 AM. The room is dark, lit only by the blue white glow of a spreadsheet and the yellow beacon of a Dallas streetlight cutting through a high-rise window. Mark Cuban had been a billionaire for all of 120 days a precarious, paper-rich billionaire whose fortune was tied to Yahoo stock in a frothy market that felt like it could vanish with one bad headline.

He had moved to Dallas 18 years earlier with nothing but the floor of a friend’s apartment as a bed. Now, an email from his broker pings into the silence, outlining the final, staggering details: $285 million for majority control of a failing, forgotten basketball team called the Dallas Mavericks. On CNBC, he would one day admit the shocking truth: he broke every rule of negotiation.

He did not haggle, did not ponder, did not deploy the strategic silence he later became famous for on Shark Tank. His response was three words: “Yes. Whatever. Done.”

This was not a calculated business move. It was not a trophy purchase. It was, in the pitch-black loneliness of a late Dallas night, the impulsive answer to a question he hadn’t fully articulated: What do you do when the city that gave you a floor to sleep on asks for a piece of your soul in return?

Chapter 1: The Unfinished Man in a City of Surfaces (1982-1990)

When Mark Cuban arrived in Dallas in 1982, the city was a monument to polished ambition. It was the era of Dallas, the TV show a world of oil barons, sprawling ranches, and deals sealed with handshakes over bourbon. Cuban was none of those things.

He was a 24-year-old from Pittsburgh, sleeping on the literal floor of an apartment in “The Village” with five roommates. His first job was bartending, his second was selling software at a store called Your Business Software, where he was fired less than a year later for prioritizing a client over opening the shop.

Dallas showed him its back first. The rejection was foundational. The city, in its glossy confidence, presented itself as a finished product. Cuban was the opposite: a work in progress, an entrepreneur with no capital, operating out of his apartment.

With $0 and the floor still as his bed, he founded MicroSolutions. His first customer, Architectural Lighting, fronted him the money for the software they needed an act of faith in the unfinished man that Dallas’s established corridors of power would not have offered.

The sale of MicroSolutions for $6 million in 1990 was less a victory lap than a release of pressure. It was proof he could finish something here. But the wealth felt hollow, a resolution without a corresponding emotional climax. He “retired” to investing, then dabbled in acting in LA, a city built on personas.

He returned to Dallas, drawn back not by opportunity, but by a sense that something here was still unresolved. The city had given him his start through a chance encounter, not through its established systems. He had succeeded in Dallas, but not yet with Dallas. A debt of belonging, unnamed and unpaid, lingered.

Chapter 2: The Pivot Point: A Static Signal and a Static Team (1995-2000)

The idea was born from static. Over lunch with his friend Todd Wagner in 1995, they bemoaned the impossibility of listening to Indiana Hoosiers basketball games in Dallas. Out of that frustration a fan’s pure, irrational desire to connect with a team from afar they built AudioNet, which became Broadcast.com. It was a billion-dollar solution to a problem of the heart.

When Yahoo bought it for $5.7 billion in 1999, the transaction was less a sale than an escape. Cuban, acutely aware the dot-com bubble was unsustainable, hedged his Yahoo stock in a trade later called “one of the top 10 of all time.” He was rich beyond measure, but now existed in a state of pure liquidity financial and existential.

Simultaneously, 900 miles away, the Dallas Mavericks were the embodiment of static. Since a promising run in the 1980s, they had decayed into irrelevance. The 1999-2000 season was another losing campaign. The games at Reunion Arena were poorly attended, the atmosphere funereal.

The franchise was a civic afterthought, a symbol of civic potential left to rust. The Dallas Morning News, owned by Belo Corp., which held a minority stake in the team, covered the losses with dutiful disappointment.

These two threads Cuban’s liquid fortune and the Mavericks’ stagnant despair converged in late 1999. The opportunity to buy the team from Ross Perot Jr. surfaced. For a negotiator whose cardinal rule was strategic silence, his instant “yes” was a screaming admission of need.

He wasn’t buying a team; he was answering the static. Broadcast.com had solved the problem of connecting a distant fan to a game. The Mavericks presented a harder, more human problem: how do you connect a city to its own heart?

Chapter 3: The Cost of Belonging: Fines, Fights, and a Forged Identity (2000-2006)

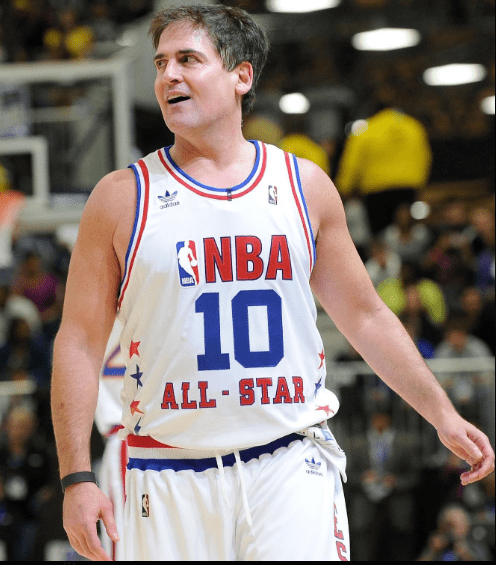

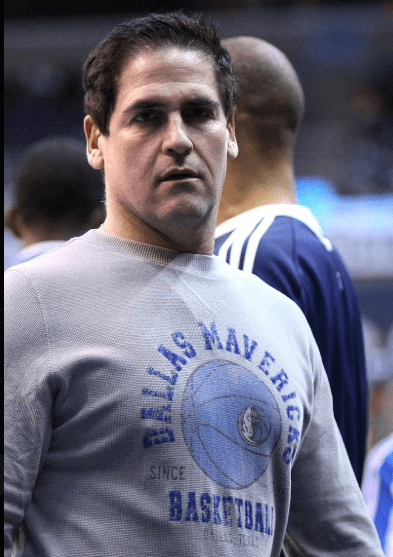

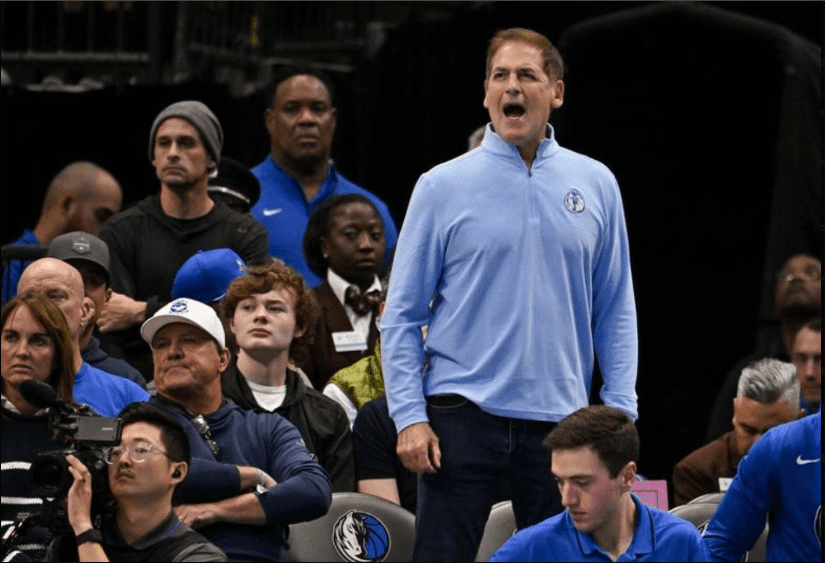

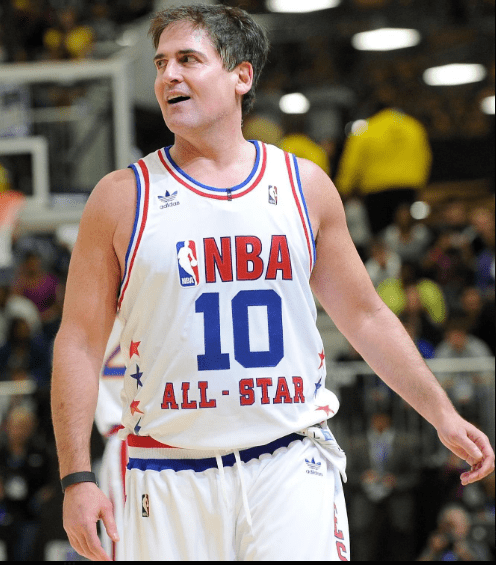

Cuban didn’t just buy the Mavericks; he invaded the NBA. He sat in the stands with fans, not the owner’s suite. He screamed at referees, investing not just capital but raw, unfiltered emotion. He would ultimately be fined more than $3 million by the league, a line item he considered the cost of a failed crusade to fix what he saw as broken officiating.

But the more telling cost was local. Just two years after his purchase, a lawsuit from his minority partners at Belo Corp., publishers of The Dallas Morning News, revealed a deeper fracture. Belo alleged Cuban reneged on a deal to buy their stake, with Cuban suggesting the newspaper’s critical coverage of the team was a factor

It was a stark lesson: changing the team was expected; challenging the city’s established power structures came with a price. He was paying fines to the league for his passion and making concessions to Dallas’s old guard for his impertinence.

On the court, the investment was emotional. He built around a soft-spoken German import, Dirk Nowitzki, creating a contender. In 2006, they reached the NBA Finals, only to collapse in spectacular, heart-wrenching fashion. The city’s hope, which Cuban had labored to manufacture, curdled into a more profound despair.

The championship that was supposed to be the triumphant end of his bargain with Dallas had slipped away. The question shifted from “Can he do it?” to “What will this failure cost him?”

Chapter 4: The Hollow Ring of the Trophy (2011)

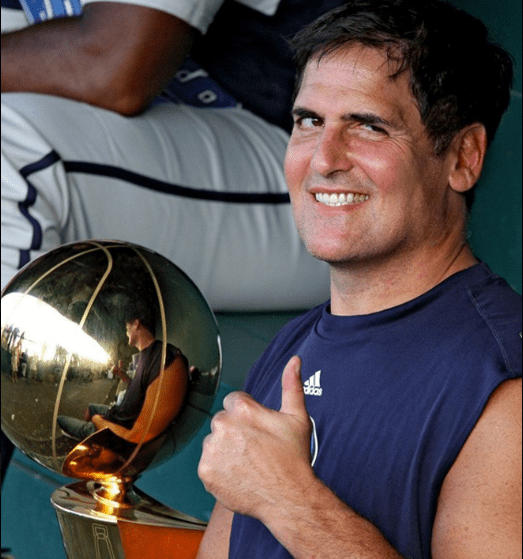

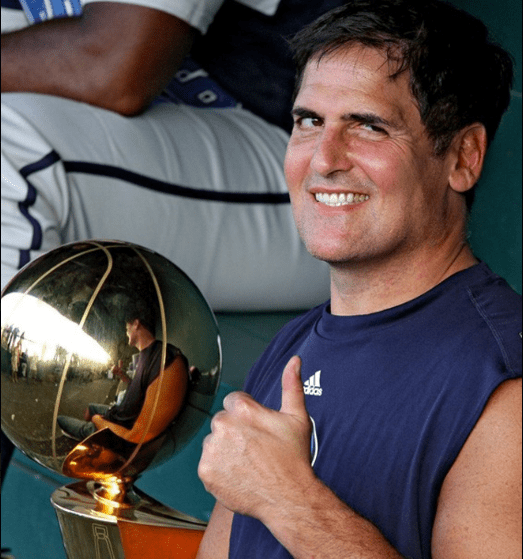

The 2011 championship should have been pure catharsis. It was the ultimate finished product, the gleaming trophy that justified every fine, every fight, every sleepless night. As the confetti fell in Miami and Dirk Nowitzki marched off the court, Cuban’s celebration was surprisingly muted.

The emotional math didn’t add up. The 13 years of struggle, the $3 million in fines, the battles with Belo and the leagu all were supposed to be redeemed by this single moment. Yet, the moment felt smaller than the journey that led to it. The championship resolved the plot but left the protagonist’s deeper need that original, unanswered question of belonging untouched.

He had given Dallas a title. But had Dallas, in return, given him a home? Or was he still the unfinished man from Pittsburgh, now just a richer, more famous version, temporarily useful to the city for the spectacle he provided?

The years after 2011 were professionally successful but narratively flat. The Mavericks remained competitive, but the urgent, unifying tension was gone. Cuban expanded his empire Shark Tank, film production, pharmaceutical startups.

He became a national celebrity. In Dallas, he was no longer the savior or the upstart; he was an institution. And an institution, by its nature, is a finished story.

Chapter 5: The Final Threshold: The Unfinished Business of Letting Go (2023)

In 2023, Mark Cuban sold a majority stake in the Dallas Mavericks at a staggering $3.5 billion valuation. The business headlines wrote the perfect closing chapter: the Pittsburgh kid buys a team for $285 million and sells it 23 years later for a 12-fold return. A masterclass in value creation.

The human story was messier. He didn’t leave. He retained a 27% stake and a loud voice in basketball operations. More tellingly, he took $35 million of the proceeds and gave it as bonuses to Mavericks employees.

It was not a shareholder dividend; it was a severance payment for a family he was choosing to stay within. The sale was not an exit. It was a restructuring of the same unresolved relationship.

He sold because, as he later said, he wanted summers with his teenage kids before they left home. It was the reason of a man no longer trying to prove he belonged somewhere, but of a man who knows where he belongs and is finally prioritizing its most fragile connections.

The purchase in 2000 was an impulsive “yes” to an unasked question. The sale in 2023 was a calculated “but” to a story he refused to end.

Epilogue: The Debt That Was Never a Debt

Today, the Dallas Mavericks are worth over $5 billion. Mark Cuban’s net worth is estimated at $6 billion. The numbers are clean, definitive, and utterly meaningless to the psychological journey they bookmark.

The truth of the 26-year bargain is this: Mark Cuban never bought the Dallas Mavericks. He rented them. He used them as the vessel through which he could finally, and at great personal expense, purchase the one thing his wealth could never acquire on its own: citizenship in the city of Dallas.

The fines were his property taxes. The championship was a necessary civic improvement. The sale was not a cashing-out, but a refinancing of that original, emotional mortgage.

He arrived as an unfinished man on a borrowed floor. He will leave, whenever that day finally comes, not as a billionaire or a champion owner, but as a Dallasite. The transaction is complete.

The conversation, however the loud, passionate, costly, and deeply human conversation he started with a city on a dark night in 2000 that remains gloriously, defiantly unresolved.