From $16 Million to $10 Billion — How NBA Team Values Exploded from Bargains to Billions Over the Last 40 Years

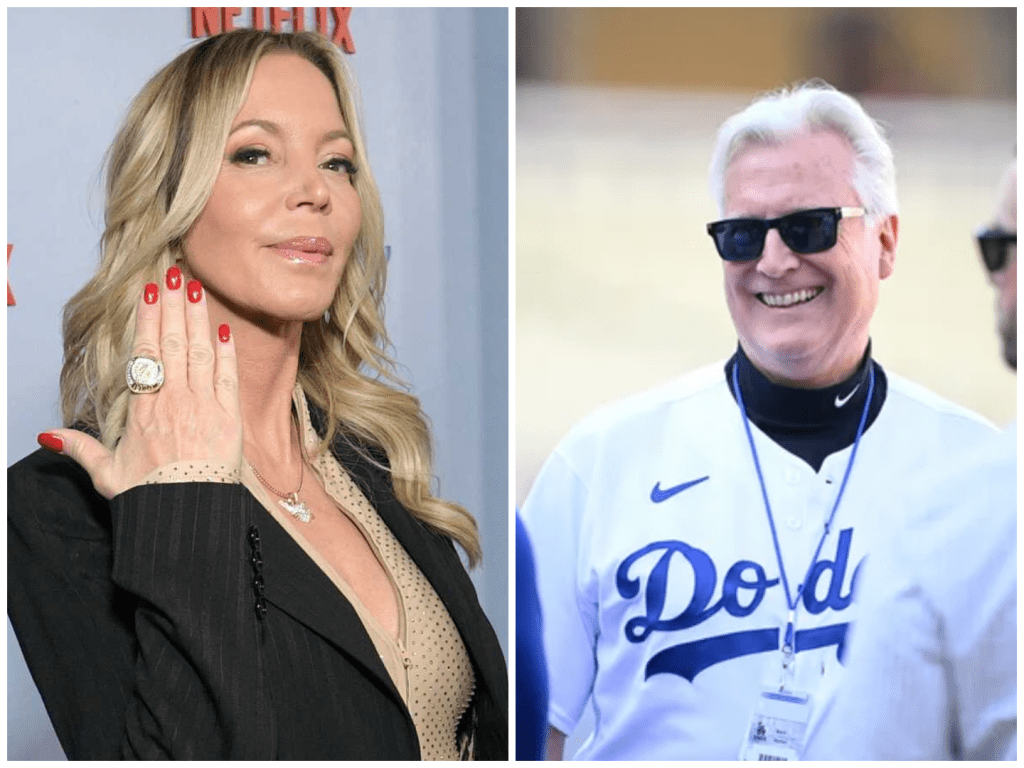

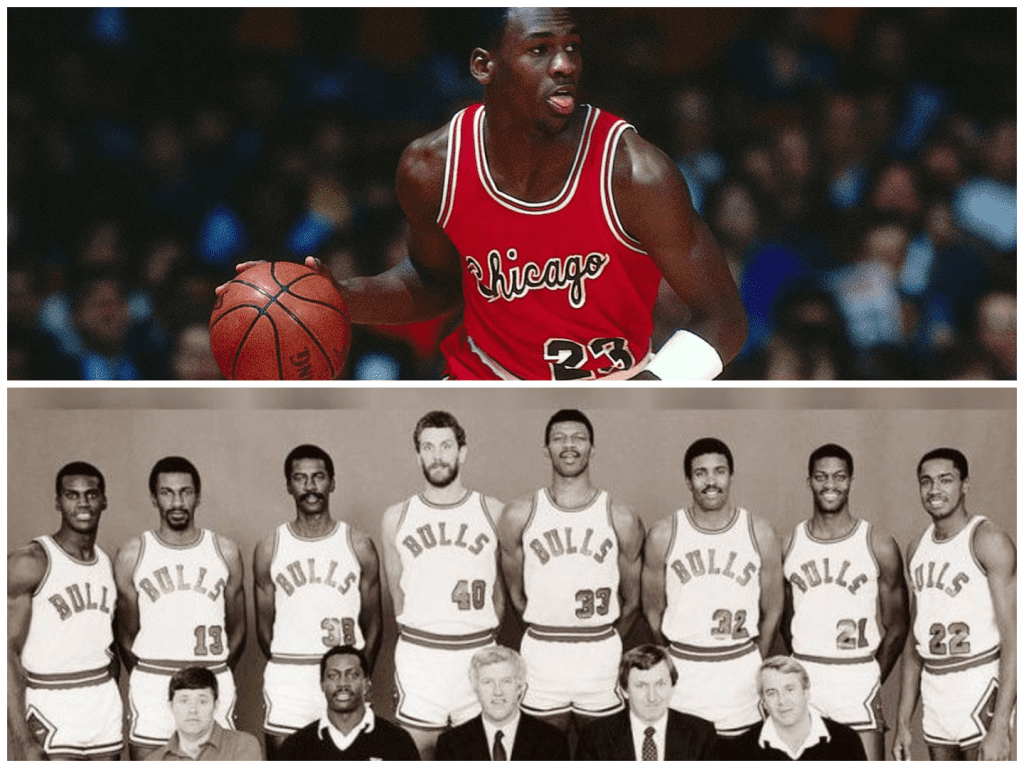

It still feels surreal when I think about it. In 1985, Jerry Reinsdorf bought the Chicago Bulls for just $16 million—a price that feels quaint now. Fast forward to 2025, and the Los Angeles Lakers sold for a staggering $10 billion. That’s a leap from “college-town budget” to “world-class empire” in a generation. Somewhere between Michael Jordan’s first championship parade and LeBron James’ Hollywood run, the entire NBA transformed—from a mid-tier property into a global juggernaut valued in the billions. And it all happened so fast.

When you sit with those numbers—the humble past meeting the dizzying present—you feel the emotional weight of history. The Bulls’ humble price captures a simpler basketball era: fewer broadcast deals, smaller stadiums, and less media hype. But behind that modest purchase were seeds of a dynasty that would define basketball culture. Imagine being Reinsdorf in 1985, handing over $16 million, thinking he was buying a team. In reality, he bought a movement. And that movement created ripple effects worth billions.

How the NBA Jumped from Punchlines to Prime Asset

The journey from scoring titles to record-breaking valuations is about more than money—it’s about vision. The NBA in the ‘80s was popular, yes, but it was light-years from today’s status. Stadiums were smaller, media coverage was limited, and the dollar signs were measured in millions. When the Bulls changed hands in 1985, it seemed huge. But there was no NBA TV explosion, no sneaker culture flooding global markets. There were just basketball fans and dust-on-the-court dreams.

Then came the boom. The league locked in major TV contracts. It moved into mainstream entertainment. Global broadcasting deals fed the brand around the world. The Bulls’ championship run wasn’t just parades in Chicago—it was prime-time domination in Tokyo, London, and everywhere in between. Every sale price after that captured a share of that expanding legacy.

The Nets sold for $3.3 billion recently, and the Hornets fetched $3 billion after nearly fading off the map. Even the Pacers, former small-town team with an $11 million price tag in 1983, now stand tall at nine figures. It’s all part of an exponential shift, driven by media rights, international reach, and the appeal of fandom as investment.

Of course, none of this would work without star power. Legends like Magic, Jordan, Kobe, and LeBron didn’t just score—they built brands that moved markets. But players are fleeting. What stays is the franchise. That’s why the Lakers—still purple and gold, still Showtime, still Hollywood—commanded a record-breaking price. Because sports franchises are now woven into city identity, global culture, and international money flows.

Feeling the High of the Billion-Dollar Boom

I remember reading that Celtics sold for $6.1 billion, and thinking, “How did a basketball team reach that number?” Then came word that Mavericks sold for $3.5 billion, Knicks for $7.5 billion, Suns and Pelicans in multi-billion deals. Hoodwinked? No. Awed? Absolutely.

Each sale carries history. Celtics: parquet floor and green banners. Mavericks: Mark Cuban era, team fused with city tech culture. Knicks: New York ambitions, Madison Square Garden mystique. And Lakers: Lakers alone carry the weight of an entire pop culture ecosystem. Their $10 billion sale to Mark Walter says it out loud: basketball franchises aren’t just teams—they’re assets, entertainment hubs, legacy vehicles.

Imagine telling someone in 1985 that the Bulls would later produce one of the era’s greatest dynasties, monetize a giant corporate identity, and contribute to sport as business spectacle. They might have laughed. But they were just missing the forest for the trees. Basketball was never just hoops. It was human drama, city pride, global storytelling. All that warmed into what sports became: a cultural mirror, a financier’s toy, a pop icon.

What This Means for Fans, Cities, and the Future

Right now, teams are worth more than Hollywood studios. Their value goes beyond court performance. It’s about arena deals, real estate, streaming rights, sponsorships, digital platforms, team apparel, food packaging, tourism, city branding—it goes everywhere.

For fans, that means your old seat now belongs in a billion-dollar venue. That jersey in your closet is part of a multi-billion-dollar merch machine. It makes the thrills feel different: celebrating a win is cheering for a multi-billion-dollar legacy, not just a game. You’re not just a fan; you’re part of a living brand.

Cities feel it, too. Ownership groups build new arenas, revitalize downtowns, lure big events—and billions of public-private investment. The Lakers aren’t just LA’s team—they’re a city asset, a billboard in real estate, a global identity card.

And this shift changes who owns teams. Gone are the local business owners. Now billionaires, media giants, investment trusts, even foreign consortiums, hold the keys. Some fans mourn that local connection. Others celebrate the money pool guaranteeing competitive stars and high-end facilities.

The data—$16M, $850M, $33M, $2B, $10B—tells the story. It’s the story of ambition, culture, entertainment, and globalized fandom. We went from bidding for a team like it was small business to bidding like it’s Hollywood. And yet we still cheer every basket, every buzzer, every dynasty forged on the court.

We’ve witnessed this explosion. We cheered when Jordan drained a turnaround jumper. We booed when Shaq slipped on the paint. But behind those moments, tracked on spreadsheets, is a much bigger truth: basketball isn’t just a game. It’s become a billion-dollar business. And we—fans, storytellers, businesses—are all part of that leap.

Because while the dollars soared, the soul stayed the same. The joy of a buzzer-beater. The unity of the crowd. The gratitude for the game. That’s what made it all worth billions in the first place.

And as proper fans, we keep watching. Even as the numbers get crazier, we’re still in it for the love of the game.