Air Jordans Only Cost $16 to Make—So Why Are We Still Paying $180+ for Them?

The $16 Secret Behind a $180 Sneaker

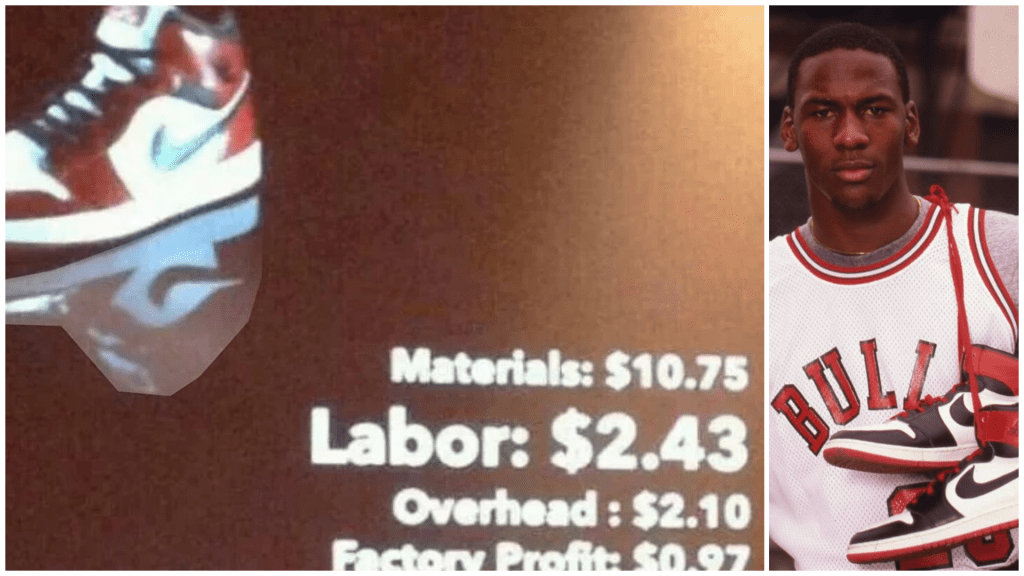

Let’s start with the headline that’s been going viral all over Instagram and Twitter: “Air Jordan 1s only cost Nike around $16 to make.” Sounds crazy, right? Especially when you walk into a sneaker store, see that $180 price tag, and wonder if you’re just paying for hype. Well, that viral claim isn’t exactly fake—but there’s more to the story than meets the eye.

The number comes from what looks like a legitimate presentation slide floating around the internet. It breaks down the cost of manufacturing a pair of Air Jordan 1s:

- Materials: $10.75

- Labor: $2.43

- Overhead: $2.10

- Factory Profit: $0.97

- Total Factory Cost: $16.25

That’s it. Sixteen bucks. Meanwhile, we’re forking over nearly $200 per pair, depending on where and how you buy them. At first glance, it feels like a scam. How can Nike justify such a massive markup? Are we all just being ripped off? Let’s take a deeper look—not just at the numbers, but at the machine behind the sneaker empire.

Why Jordans Cost So Little to Make, But So Much to Buy

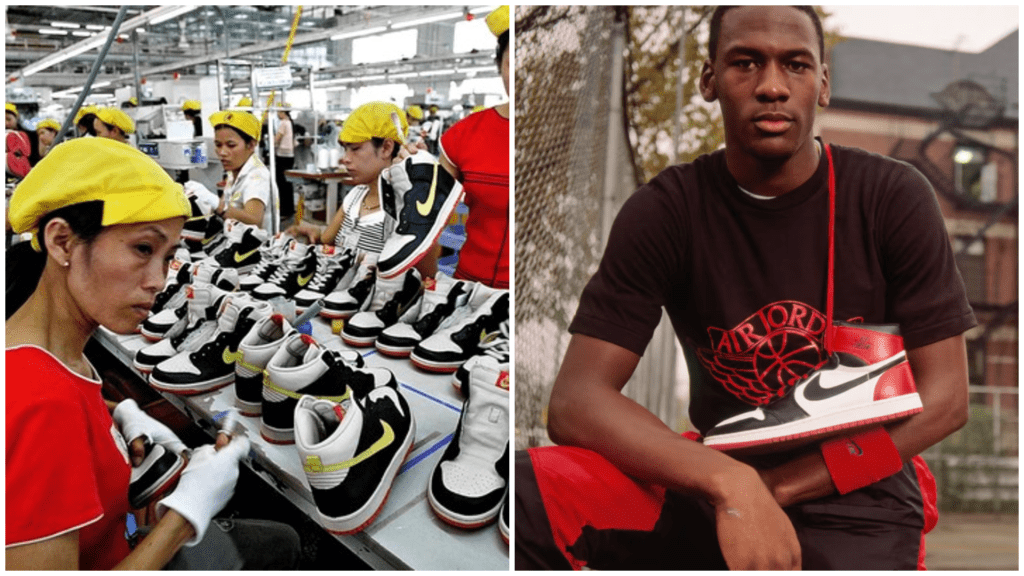

To understand this, we have to first realize that the $16.25 cost isn’t what Nike pays to get shoes into stores. That number is only the cost at the factory level—what Nike pays a third-party manufacturer, usually in countries like Vietnam or China. It includes raw materials, basic labor, some factory overhead, and a tiny bit of profit for the factory. But the real expenses start after that.

Think about what has to happen after the shoe leaves the factory floor.

- It has to be shipped—sometimes across continents.

- It gets stored in warehouses, sorted, tracked, and distributed to stores or fulfillment centers.

- Nike spends millions on marketing every year—those flashy campaigns, social media hype, athlete endorsements, and collaborations all cost money.

- There’s design, research, and development, especially with exclusive drops and tech like Nike Air or Zoom soles.

- Then come the retailers—Foot Locker, Champs, boutiques—who also take a cut, because they have staff, rent, and their own bills to pay.

Finally, Nike still needs to make a healthy profit margin. And why wouldn’t they? The sneaker business isn’t a charity—it’s one of the biggest lifestyle brands in the world.

When you include all those layers, the price tag starts making a bit more sense. Maybe not $180 sense, but you can at least understand why it’s not just a $16 item being sold 10x higher.

Still, you can’t talk about the Air Jordan pricing without mentioning one huge factor: hype and brand power.

Let’s be real—Jordans are more than shoes. They’re status, history, collectibles, culture. People don’t just wear Jordans—they post them, show them off, collect them, and sometimes never even take them out of the box. That emotional and cultural value adds a premium that no cost sheet can explain.

When you buy Jordans, you’re not just buying rubber and leather. You’re buying the story of Michael Jordan. You’re buying into sneaker culture. You’re buying the right to be part of a community that spans decades, race, income, and geography. That kind of brand loyalty is priceless—for Nike at least.

Social media plays a big role here too. Sneakerheads line up for hours, crash apps, and pay resellers double or triple the retail price. And that only boosts the value perception. Nike doesn’t even have to explain the markup anymore—the crowd does it for them.

Still, when you go back to that $16 figure, it does sting a little. Especially when you realize that most of that money goes overseas, and the people making the shoes are earning just a few dollars per pair. The $2.43 labor cost isn’t even what a worker earns—it’s the factory’s labor per unit, which could mean the actual worker takes home less than a dollar.

That opens a bigger conversation about labor rights, ethical manufacturing, and corporate profit margins. Should Nike be doing more to raise factory wages, or reinvest in communities? Should they lower prices if their profit margins are already massive? These are questions worth asking—especially when we, the consumers, are the ones funding it.

But it’s not just Nike. Almost every major sneaker brand follows the same model. Adidas, Puma, New Balance—they all use outsourced factories, often in countries where labor laws are weak and wages are low. Nike just happens to be the most visible because of the Jordan brand’s cultural dominance.

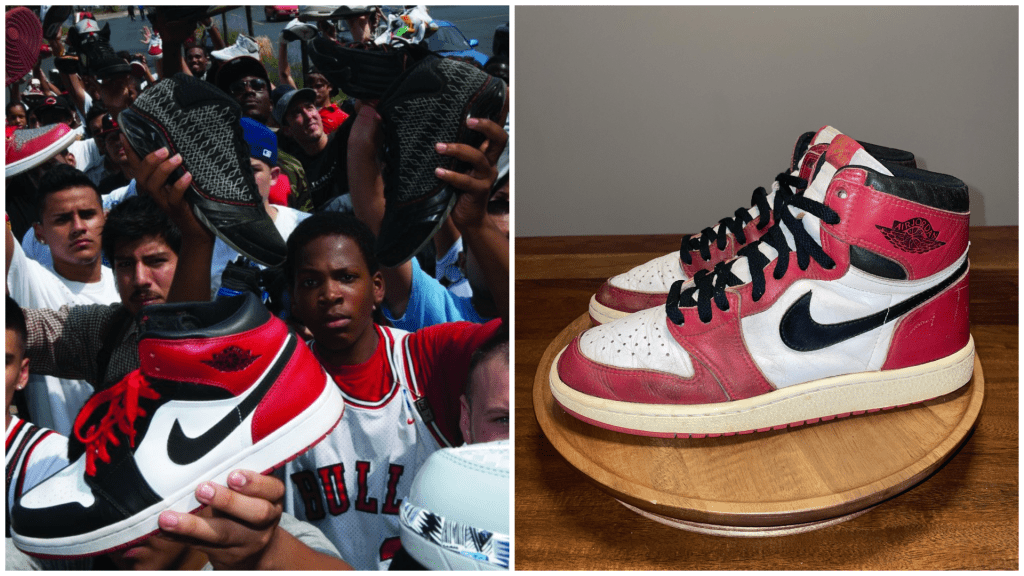

And here’s something wild: that $180 retail price isn’t even the highest point of the Air Jordan economy. On the resale market, limited edition Jordans can go for $500, $1,000, even $5,000+. And that’s not money Nike sees—it’s consumers selling to each other. Nike’s retail markup starts to feel modest when you realize how much people are willing to pay once the shoe is “rare.”

So yeah, that viral image isn’t a lie. Air Jordan 1s do cost about $16 to make in the factory. But by the time the shoes are shipped, stored, marketed, and sold—plus the intangible hype tax—we’re talking about a totally different beast.

At the end of the day, Nike doesn’t force anyone to pay $180. People line up willingly. They refresh apps at 7am. They shell out triple for resale. That’s not just a markup. That’s a masterclass in brand psychology.

You can call it smart business. You can call it exploitation. The truth is, it’s probably both.