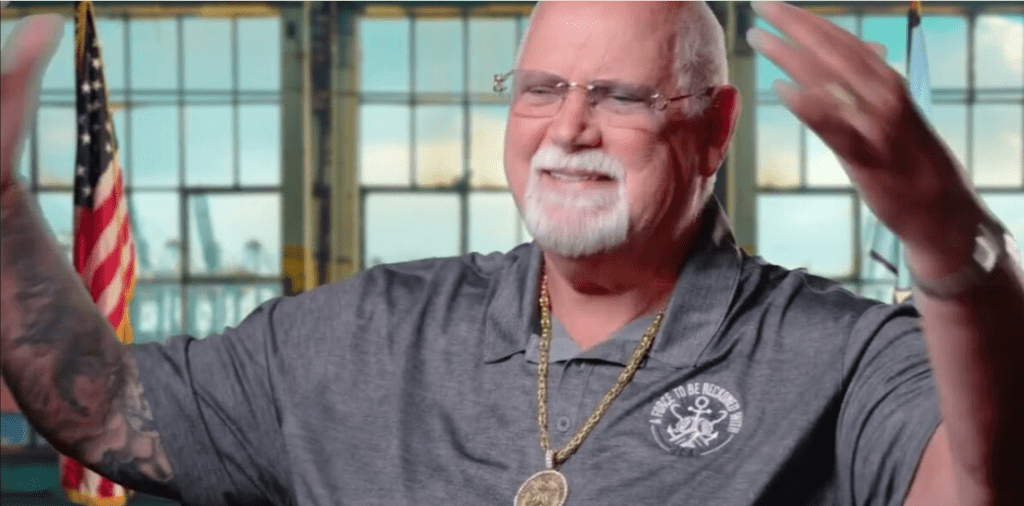

How Latrell Sprewell’s $1.5 Million Yacht Became the Anchor That Sank His Fortune

The most jarring image of Latrell Sprewell’s demise is not a missed jump shot or a defensive lapse. It is the cold, bureaucratic spectacle of a federal marshal seizing a 70 foot Italian yacht named “Milwaukee’s Best” from a Wisconsin harbor in the summer of 2007. This was not a strategic sacrifice. It was a repossession. The vessel, a $1.5 million floating trophy purchased at the height of his fame, was sold at auction for a paltry $856,000, leaving the four-time NBA All Star still owing nearly half a million dollars on its mortgage. The seizure of the yacht was the most vivid public symptom of a catastrophic, systemic financial collapse already in terminal phase. Just months later, banks would initiate foreclosure on his River Hills mansion.

The state of Wisconsin would name him its top tax delinquent, owing millions. This is the story of a stunning, self-inflicted economic implosion that stands as professional sports’ most potent cautionary tale. It is a narrative that begins with an unfathomable act of pride the rejection of a $21 million contract extension and ends with a former millionaire facing noise violation tickets at a rented bungalow. Sprewell’s journey is not merely about money lost; it is about a complete psychological rupture from reality. He mistook a paycheck for a birthright, and in doing so, engineered his own demise not on the court, but in the courtrooms and bank ledgers that stripped him of every tangible symbol of his success.

To understand the sheer scale of Sprewell’s financial freefall, one must first appreciate the peak from which he jumped. In his final NBA season with the Minnesota Timberwolves in 2004-05, he was earning $14.6 million per year a salary that placed him among the league’s top ten. As that contract neared its end, the Timberwolves offered him a three year, $21 million extension. In the cold math of aging athletes, it was a generous offer for a 34 year old in decline. Sprewell’s rejection was a philosophical statement of perceived self worth. He infamously declared, “Why would I want to help them win a title? They’re not doing anything for me. I’ve got a lot at risk here. I’ve got my family to feed.” The quote entered the sports lexicon as a symbol of profound disconnect.

His agent advised holding out for a better deal, even stating Sprewell would not “stoop or kneel” to accept a $5 million mid level exception. This strategy presumed a demand that did not exist. No other team called. The 2005 offseason passed. Latrell Sprewell, at age 35, was suddenly and permanently out of the NBA. The $21 million safety net was gone. The $14.6 million annual geyser had stopped. And the bills on a lifestyle built for a king were just beginning to come due.

The Anatomy of a Collapse: How the Debts Stacked Faster Than Points

Sprewell’s financial ruin was caused by a cascade of fixed, extravagant liabilities that continued to demand payment long after his income stream vanished. The most symbolic was the yacht, “Milwaukee’s Best.” Purchased in 2003 through his company LSF Marine Holdings, it came with a brutal monthly mortgage of $10,322. This was not a one off purchase; it was a perpetual financial anchor. When Sprewell stopped making payments and failed to maintain insurance, North Fork Bank moved. The auction sale failed to cover the $1.3 million debt, leaving a $500,000 shortfall haunting him.

Simultaneously, his primary residence a home in the affluent Milwaukee suburb of River Hills was also in jeopardy. He had stopped making the $2,593 monthly mortgage payments. By early 2008, the bank filed for foreclosure, citing nearly $300,000 in outstanding payments plus interest. While he eventually settled to avoid a sheriff’s sale, it was a temporary reprieve in a losing war.

Beneath these visible debts festered a far more insidious liability: tax evasion. Court records later showed Sprewell owed the state of Wisconsin more than $3 million in back taxes, earning him the state’s top spot on its list of delinquents. This wasn’t an oversight; it was a massive, compounding debt with penalties and interest that would cripple any recovery.

This trifecta luxury asset debt, real estate debt, and government debt formed an inescapable trap. Each required five-figure monthly outlays he could no longer afford. The math was simple and brutal: Zero income cannot service millions in fixed expenses. His wealth didn’t evaporate; it was systematically repossessed and claimed by entities with far more power than any NBA defender.

The Psychology of the Fall: Pride, Entitlement, and a Fatal Misreading of the Market

The financial mechanics are straightforward. The psychological drivers are complex and reveal a mindset that plagues many star athletes. At its core was a profound entitlement. Sprewell’s “family to feed” comment was not about literal starvation; it was a metaphor for maintaining a lifestyle he believed he was owed in perpetuity. He viewed the $21 million offer not as future earnings, but as an insult to his past contributions. This mentality blinded him to the cold reality: your value is what the market will pay today, not what you were worth yesterday.

This was compounded by catastrophically bad counsel. His agent’s strategy to wait out the market was a gross misreading of the NBA’s landscape and Sprewell’s own depreciating value. The advice transformed a negotiation into a career ending standoff.

Sprewell also exhibited a classic symptom of financial dissociation. He spent as if his peak earning years were a permanent state. The yacht, the mansion, the lifestyle all were funded on the assumption that the $14.6 million annual income was a floor, not a ceiling. He failed to differentiate between wealth and cash flow. He had massive expenses but no plan to create passive income or capital reserves once the active NBA checks stopped.

This psychology created a reality distortion field. Even as banks seized his assets and the state pursued him for millions, his public persona suggested a man in denial. Years later, he was cited for noise violations at a rented bungalow in Milwaukee, a stark contrast to the quiet luxury of his foreclosed estate. The fall was not just financial; it was a complete departure from the world he once inhabited.

The Wider Context: Sprewell as the Ultimate Cautionary Tale in a League of Burnouts

Latrell Sprewell’s story is extreme, but not unique. It exists on a spectrum of professional athletes who earn life altering money and end up bankrupt. He embodies every classic pitfall.

He is the avatar of “Lifestyle Inflation” gone malignant. His fixed costs rose to meet and then exceed his astronomical income. When the income vanished, the costs remained, acting like financial vampires.

He exemplifies the “Yes Men” syndrome. The lack of any visible, forceful financial advisor to counter his and his agent’s hubris is glaring. There was no one in his circle willing to say, “This is a good offer. Take it, secure your family, and then manage your spending.” Instead, he was surrounded by enablers who validated his inflated self worth.

His case also highlights the danger of conflating brand with skill. Sprewell was a famous, controversial star. He may have believed his notoriety had its own monetary value. It did not. The NBA only pays for current basketball utility.

Finally, his tax debt reveals a particularly disastrous form of magical thinking. Ignoring multi-million-dollar tax obligations isn’t a strategy; it’s a fantasy that the rules don’t apply. The government, unlike a bank, has nearly unlimited power to collect. This debt alone doomed any chance of a stable financial future.

The Aftermath: From Foreclosed Mansions to a Rented Bungalow

The final stage of Sprewell’s financial journey is a portrait of staggering diminishment. The man who once owned a yacht and a mansion was, by 2013, renting a 2,044 square foot bungalow on Milwaukee’s East Side. The house was a fraction of his former holdings. He was a tenant, subject to a landlord and local noise ordinances. His massive state tax debt was whittled down to $110,000 a Herculean effort that still represented a monumental burden.

In a minor redemption, later reports indicate Sprewell eventually found work in community relations with the New York Knicks, leveraging the one asset he never lost: his name. His estimated net worth was listed at $150,000 a sum he once might have spent on a single piece of jewelry.

The Unseen Victims: The “Family to Feed” in a Financial Famine

The cruelest irony is the fate of the very family he claimed he was protecting. When he declared he needed to “feed his family,” he framed himself as a provider. His collapse exposed that as a hollow slogan. True provision involves long term security, education funds, and generational planning not monthly yacht payments.

The foreclosure and asset seizures represented a profound failure of this duty. The stability he promised was replaced with legal chaos, public humiliation, and a drastic downgrade in living standards. The “family” was not fed; it was exposed to the trauma of financial instability. This transforms Sprewell’s story from a personal tragedy to a moral failing. His pride and poor decisions pulled his dependents into the vortex of his downfall.

The Verdict: A Self Made Tragedy With a Permanent Legacy

Latrell Sprewell’s story is not one of bad luck. It is a textbook case of self-sabotage. He was not a victim of circumstance; he was the architect of his own ruin.

The verdict is clear: he overvalued himself, undervalued security, and ignored every principle of wealth management. He turned down generational wealth for the fleeting satisfaction of perceived respect. He chose monthly liabilities over long term assets. He ignored the tax man until the tax man owned him.

His legacy in basketball is dual: a fierce, captivating competitor, and the man who choked his coach. His legacy in finance is singular: the ultimate “What Not To Do” case study.

For every young athlete, the lesson is screamingly obvious: Your career is temporary. Your ego is expensive. Your family’s future is the only contract that truly matters. Sprewell fed his ego, and in the end, it consumed everything the yacht, the mansion, the fortune, and very nearly the future of the family he swore he was protecting. In the final accounting, the banks got the boat. The state got its due. And Sprewell was left with a permanent, cautionary tale etched in the history of sports and finance.