From a Sloppy Pitch to a Billion-Dollar Brand

Back in 2013, Stephen Curry was fresh off his breakout season and Golden State’s surprising drive into the playoffs. He headed into a meeting at Nike’s headquarters—undoubtedly expecting to feel seen, appreciated, and valued for what he was becoming. Instead, he walked away feeling dismissed.

This moment marked the beginning of a critical understanding for Curry: why Stephen Curry will never work with nike became a fundamental realization in his career.

According to a widely shared recap by Jeremy Kuo, the meeting was a cascade of missteps: Nike executives repeatedly mispronounced his name—saying “Stephon” instead of “Stephen.” The slides shown were just copied from a Kevin Durant presentation, complete with Durant’s name. These details weren’t minor—they were glaring signs that Curry wasn’t taken seriously. Dell Curry, his father, later described that meeting as “cold and transactional,” like his son was being treated as a commodity, not a future cornerstone. Nike didn’t offer Curry a signature shoe, much less any equity. And, disturbingly, some of their “prototypes” included shoes like penny loafers, clearly undermining the moment both on style and sincerity.

Meanwhile, Under Armour was quietly preparing to pounce. Kevin Plank and his leadership saw something Nike didn’t: Curry’s narrative, his potential, his values. They offered him not just a contract, but ownership—$4 million a year plus equity in the company. It was a rare move: Under Armour wasn’t just paying for performance, they were betting on Curry’s brand developing over time.

This relationship was the start of a decade‑long arc that transformed both parties—and it wouldn’t have happened if not for that disastrous pitch at Nike.

The Value of Belief: From $14 Billion to $28 Billion and Beyond

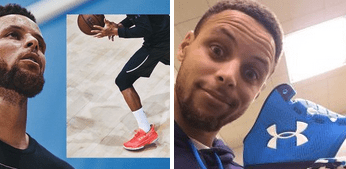

Under Armour took a calculated risk—and it paid off in spades. By 2023, the Curry Brand, a separate sub-brand officially launched in 2020, had firmly established itself in the market. Curry took over as president of the line and received $75 million in company shares. The deal was widely described as a $1 billion “lifetime contract”.

Market valuation mirrored the brand’s growing influence. Under Armour’s basketball division, which was valued at around $14 billion back when Curry signed on, had potentially doubled by the mid‑2020s thanks to his impact—from brand visibility to shoe sales, to cultural influence.

Under Armour’s stock, the company’s broader public image, and its place in basketball culture were all elevated. Curry became one of the few athletes to earn more annually from endorsements and equity than his playing salary—a testament to Over Armour’s savvy in leveraging his star power.

Curry’s off‑court ventures only enriched this narrative. Curry Brand’s success helped fuel the growth of his Thirty Ink venture, which includes Unanimous Media, Gentleman’s Cut bourbon, and Underrated golf and basketball. That company netted $173.5 million in 2024 alone, much of it due to Curry’s continuing partnership with Under Armour.

The Broader Lesson: Relationships Over Metrics

What went wrong at Nike wasn’t just about mispronouncing a name. It was emblematic of a deeper issue: prioritizing efficiency over human connection. They had reams of performance data, market analytics, and all the right credentials—but they missed the one thing that couldn’t be quantified: Curry’s story, his authenticity.

As Kuo put it: “Nike knew his market price, but not his potential.” Under Armour, on the other hand, insisted on believing in Curry rather than buying him. The equity stake wasn’t just business; it was symbolic—they were partners. In a world increasingly driven by numbers, Under Armour had rediscovered an age-old idea: respect scales exponentially, and connection multiplies value.

This principle still matters today—from startups courting customers, to employers building teams, to brands engaging fans. Curry’s rise, powered by a contract that honored his value beyond stats, stands as a powerful story of long‑term thinking.

The Impact, A Decade Later

It’s now over a decade since Curry made that decision. Since then, he’s won four NBA championships, been named league MVP, redefined the point guard position, and set all-time records for three-pointers.

Financially, he now earns more from endorsements and brand ventures than on-court pay. In the 2024–25 season, he surpassed LeBron James as the highest-paid NBA player with $155.8 million in combined salary and endorsements—much of which ties back to his long-standing Under Armour deal.

Meanwhile, Under Armour’s “Curry Brand” continues evolving. They dropped their 10th signature sneaker with Curry in 2022 and keep releasing popular collaborations—some with Sesame Street, Bruce Lee, and Stone Island—building a diversified cultural footprint.

Steph Curry’s Thirty Ink continues to flourish too. He’s become a major force in media, lifestyle, philanthropy, and even women’s sports by investing in the Unrivaled women’s 3-on-3 league, backed by $100 million in funding, including Curry’s involvement.

What If Nike Had Gotten It Right?

It’s easy now to say Nike blew a billion-dollar opportunity. But what if they’d simply shown respect—used Curry’s name correctly, personalized their pitch, shown belief rather than data?

They held sway in the industry, but that meeting revealed a blind spot. GM Nico Harrison, who led the pitch, even later landed the position in Dallas—and his fumbles have continued to define his career.

That missed connection with Curry is a stark case study on what happens when you treat people like transactions.

Final Takeaway

Nike’s misstep wasn’t massive—just small details added up: a name mispronounced, a slide reused, no ownership offered. But to Curry, it was enough to walk toward something better, somewhere he felt seen.

Under Armour’s success wasn’t overnight—it was built on a bold, intentional belief in a person, not just a player. Over time, that respect compounded into billions in value, influence, and legacy.

In the end, this isn’t just a sports business story—it’s a reminder that behind every metric lies a person. And believing in them might just be the most valuable investment of all.